Canada’s research and development tax credit system is a great financial opportunity for many  businesses across all industries.

businesses across all industries.

However, market research shows that many eligible organizations experience significant difficulty in determining which projects are eligible and as a result many go unclaimed.

Add to that complex legislation and time intensive report preparation and businesses which are otherwise eligible to take advantage of SR&ED, may not make the effort.

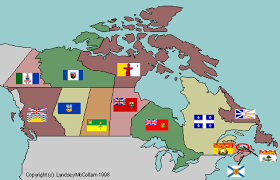

One of the benefits of working with a professional consulting firm is that you are informed of all possible R&D funding opportunities. Most Canadian provinces and territories offer additional R&D tax incentives at a provincial level, therefore it is essential to be informed of all opportunities and how they fit together.

Enhanced Capital Recovery’s services include application for both the Federal and Provincial SR&ED programs. As SR&ED experts, you can expect your claim to be thoroughly processed, and optimized to meet CRA’s strict expectations. In the case of a review, we will be there to assist and guide you throughout the process.

A big part of our SRED service is that contacting us for an assessment is risk free. In fact we’re so confident in our ability to accurately assess and deliver successful SRED claims, that all of our services are based on a percentage of tax credits granted.

Contact us today for a free, no obligation consultation!

The following is an overview of all Provincial and Territorial research and development tax credits across Canada as of December 31st, 2015.

“Newfoundland and Labrador

Research and development tax credit

The Newfoundland and Labrador research and development tax credit is administered by the Canada Revenue Agency (CRA) and is fully refundable at the rate of 15% of eligible expenditures.

Eligible work and expenditures:

Those that qualify for federal SR&ED tax credits

Filing deadline for claiming the credit:

12 months after the filing due date

Provincial Web site:

Newfoundland and Labrador – Research and Development Tax Credit

Nova Scotia

Research and development tax credit

The Nova Scotia research and development tax credit is administered by the CRA and is fully refundable at the rate of 15% of eligible expenditures.

Eligible work and expenditures:

Those that qualify for federal SR&ED tax credits

Filing deadline for claiming the credit:

18 months after the corporation’s tax year-end

Provincial Web site:

Nova Scotia – Research and Development Tax Credit

New Brunswick

Research and development tax credit

The New Brunswick research and development tax credit is administered by the CRA and is 15% Refundable on eligible expenditures incurred after December 31, 2002, and 10% Non-refundable on eligible expenditures incurred before January 1, 2003.

Eligible work and expenditures:

Those that qualify for federal SR&ED tax credits

Filing deadline for claiming the credit:

Not applicable

Carryback / carryforward:

Non-refundable tax credits can be carried back 3 years and forward 7 years.

Provincial Web site:

New Brunswick – Research and Development Tax Credit

Quebec

For information with respect to Quebec’s R&D tax credits, please visit the provincial Web site at:

Scientific Research and Experimental Development – Quebec

Ontario

Ontario innovation tax credit (OITC)

The Ontario innovation tax credit is administered by the CRA after December 31, 2008, and is fully refundable at the rate of 10% of qualified expenditures.

The annual expenditure limit of $3,000,000 of qualified expenditures is phased out when the corporation’s taxable paid-up capital for its preceding tax year exceeds $25,000,000 and, it is eliminated when it reaches $50 million. The expenditure limit is also phased out when the corporation’s taxable income for its preceding tax year is over $500,000 but does not exceed $800,000.

Eligible work and expenditures:

Only expenditures for SR&ED carried on in Ontario, for which the taxpayer is eligible for the federal SR&ED investment tax credit (ITC), qualify for the OITC.

Ontario rules draw on the federal SR&ED rules relating to the definition of SR&ED, qualified expenditures, the expenditure limit, and its reduction based on prior-year taxable income.

Filing deadline for claiming the credit:

Not applicable

Ontario business-research institute tax credit (OBRITC)

The Ontario business-research institute tax credit is administered by the CRA after December 31, 2008, and is fully refundable at the rate of 20% of qualified expenditures.

There is a $20 million annual cap. The cap must be allocated within an associated group of corporations.

Eligible work and expenditures:

Ontario rules mirror federal SR&ED rules regarding the definition of SR&ED and qualified expenditures other than an expenditure that may reasonably be considered to fund the payment of salary or wages to an employee of the eligible research institute who is connected to the corporation making the expenditure or a prescribed type expenditure.

Filing deadline for claiming the credit:

Not applicable

Ontario research and development tax credit (ORDTC)

The Ontario research and development tax credit (ORDTC) is administered by the CRA after December 31, 2008 and is non-refundable at the rate of 4.5% of eligible expenditures.

Eligible work and expenditures:

Those that qualify for federal SR&ED tax credits Prescribed federal form T2SCH31 must be filed to claim the ORDTC.

Filing deadline for claiming the credit:

Not applicable

Carryback / carryforward:

Carry back 3 years to reduce Ontario corporate income tax payable, but not to a tax year that ends before January 1, 2009.

Carry forward 20 years

Ontario transitional tax debits and credits

The Ontario transitional tax debits and credits are administered by the CRA after December 31, 2008.

Corporations may be subject to an Ontario transitional tax debit or be eligible to claim an Ontario transitional tax credit due to the harmonization of the two legislative acts governing federal and Ontario income taxes.

Manitoba

Research and development tax credit

The Manitoba research and development tax credit is administered by the CRA and is non-refundable at the rate of 20% on eligible expenditures incurred after March 8, 2005, and 15% on eligible expenditures incurred before March 9, 2005.

Eligible work and expenditures:

Those that qualify for the federal SR&ED tax credit

Filing deadline for claiming the credit:

1 year after the filing due date

Carryback / carryforward:

Non-refundable tax credits can be carried back 3 years and forward 10 years for tax years ended after 2003 and carried back 3 years and forward 7 for tax years ended before 2004 and applied against the Manitoba income taxes payable.

The non-refundable tax credit carry forward period has been extended to 20 years for tax years ended after 2005.

Provincial Web site:

Manitoba – Research and Development Tax Credit

Saskatchewan

Research and development tax credit

The Saskatchewan research and development tax credit is administered by the CRA and is non-refundable at the rate of 10% for all eligible expenditures after March 31, 2015, 15% for all eligible expenditures occurring before March 19, 2009, and refundable at the rate of 15% for all eligible expenditures occurring after March 18, 2009 and before April 1, 2015.

Effective for qualifying R&D expenditures incurred on or after April 1, 2012, the refundable R&D Tax Credit for Canadian-controlled private corporations (CCPC) will be subject to a maximum annual limit of $3.0 million in qualifying expenditures. Qualifying expenditures in excess of this annual limit, as well as all qualifying expenditures by other corporations, will now be eligible for a 15% non-refundable R&D Tax Credit. The non-refundable credit can be carried back 3 years and forward 10 years to be applied against Saskatchewan Corporation Income Tax otherwise payable.

Provincial Web site:

Saskatchewan – Research and Development Tax Credit

Alberta

Scientific research and experimental development tax credit

The Alberta scientific research and experimental development tax credit is administered by the Alberta Ministry of Finance and Enterprise and is refundable at the rate of 10% on up to $4 million in eligible expenditures of a qualified corporation, for a maximum credit of $400,000.

Eligible work and expenditures:

Those that qualify for the federal SR&ED tax credit and were incurred in Alberta after December 31, 2008

Filing deadline for claiming the credit:

15 months after the corporation’s filing due date

Provincial Web site:

Alberta Corporate Tax Overview – Includes SR&ED tax credit links

British Columbia

Scientific research and experimental development tax credit

The British Columbia scientific research and experimental development tax credit is administered by the CRA and is refundable for CCPCs up to 10% of the expenditure limit (i.e., $3m x 10% = $300,000) and non-refundable otherwise at a rate of 10% of SR&ED qualified British Columbia expenditures.

Eligible work and expenditures:

British Columbia rules parallel the federal SR&ED rules relating to the definition of SR&ED, qualifying expenditures, and the expenditure limit.

The tax credit is refundable for CCPCs at the rate of 10% of the corporation’s SR&ED British Columbia qualified expenditures for the tax year.

The British Columbia SR&ED tax credit has been extended to allow corporations that are members of partnerships to claim their proportionate share of the partnership’s SR&ED carried on in British Columbia, for qualified expenditures after February 20, 2007.

Filing deadline for claiming the credit:

18 months after the corporation’s tax year-end

Provincial Web site:

British Columbia – Research and Development Tax Credit

Yukon

Research and development tax credit

The Yukon research and development tax credit is administered by the CRA and is refundable at the rate of 15% of eligible expenditures. An additional 5% is available on amounts paid or payable to the Yukon College.

Eligible work and expenditures:

Those that qualify for federal SR&ED tax credits

Filing deadline for claiming the credit:

12 months after the filing due date

Territorial Web site:

Yukon – Research and Development Tax Credit”

“Scientific Research And Experimental Development Tax Incentive Program”. Cra-arc.gc.ca. N.p., 2015. Web. 16 Apr. 2016.