Provincial and federal governments recognize that innovation requires financing. They are also quite aware of the significant economic value of supporting business innovation and therefore, have research and development funding for business innovation programs in place to put their money where their mouth is. To put this in perspective, the federal and provincial governments combined to provide $7.01 billion in R&D funding in 2012.

Depending on your project, innovation financing can come in various forms, including tax credits, grants and more. The following are some of the major sources of innovation financing that your business should consider.

Federal tax credits

Applying for an R&D tax credit often involves an intensive amount of documentation and follow-through to demonstrate you satisfy the program requirements. All things considered, however, the size of the credit available can make applying worth your time.

Applying for an R&D tax credit often involves an intensive amount of documentation and follow-through to demonstrate you satisfy the program requirements. All things considered, however, the size of the credit available can make applying worth your time.

For instance, the Canada Revenue Agency’s Scientific Research and Experimental Development program, commonly known as SR&ED, provides tax credits of up to 35% of qualifying expenditures such as salaries, capital costs, consulting fees and materials. For most SMEs, these investment tax credits take the form of a cash refund.

To be eligible, the Canada Revenue Agency (CRA) determines whether or not your project meets the Scientific Research & Experimental Development (SR&ED) specifications using the following three criteria:

- Technological Advancement – furthered technical knowledge

- Technological Uncertainty – faced technical challenges or uncertainties

- Technical Content – went through an iterative process to try and overcome those challenges or uncertainties

These 5 easy questions (see the full article 5 easy question guide for SR&ED eligibility for more detail) should help you decide if you have a potential claim.

1. “Was there a scientific or a technological uncertainty that could not be removed by standard practice/engineering?”

2. “Did the effort involve formulating a hypothesis specifically aimed at reducing or eliminating the uncertainty?”

3. “Was the adopted procedure consistent with the total discipline of the scientific method, including formulating, testing, and modifying the hypothesis?”

4. “Did the process result in a scientific or technological advancement?”

5. “Was a record of the hypothesis tested and results kept as the work progressed?

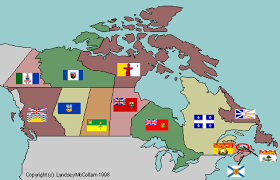

Provincial and territorial R&D tax credits

With the exception of except Prince Edward Island, the Northwest Territories and Nunavut, every  provincial and territorial government has its own R&D tax credit.

provincial and territorial government has its own R&D tax credit.

Like the federal government program, the administrative details and eligibility of spending can be complex. Enhanced Capital Recovery can help you decide which R&D tax credits you should apply for.

Grants for R&D

Depending on your business sector, you could have access to federal government grants and financial assistance for your R&D.

Grants targeting specific industries across Canada can be found at the Canada Business Network. There are also many provincial and territorial grants and financing programs. These can also be found on the Canada Business Network portal or by contacting your provincial or territorial government.

Need help building a Canadian government funding strategy?

Although R&D programs are not highly visible, assistance is available for those who know where  to find it.

to find it.

When it comes to preparing an application, working with a SR&ED consultant lets you invest your time in other areas of the business and ensures that day-to-day operations will not be disrupted.

Enhanced Capital Recovery is here to help you from beginning to end of the process. We often discover non-intuitive expenses and activities that are routinely overlooked or unclaimed as well as help you implement a tracking tool to simplify the process of your future claims.

With zero upfront fees, there is absolutely no risk to your business to access the proven effectiveness of our team!