The SR&ED program defines, “overhead and other expenditures” as expenditures that may  be directly attributable to the prosecution of SR&ED in Canada.

be directly attributable to the prosecution of SR&ED in Canada.

Overhead expenditures in SR&ED, importantly are not to be confused with the definition commonly used under the generally accepted accounting principles in Canada. GAAP accounting rules refer to overhead as an indirect cost. This does not hold true for SR&ED, however, as overhead and expenditures must be directly attributable to the SR&ED activity to be eligible.

The test to determine what expenses are directly attributable

The CRA has developed two tests to show what expenses are directly attributable to the prosecution of SR&ED: “The expenditure must be directly related to the prosecution of SR&ED in Canada; and the expenditure would not have been incurred had such prosecution not occurred.”

A portion of directly attributable expenses may be allowable

If a portion of an expenditure is directly attributable to the prosecution of SR&ED the portion of the expenditure can be allocated to SR&ED work on a “reasonable basis.”

The importance of direct link to SR&ED work

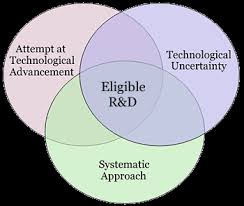

In order for an expenditure to be eligible for SR&ED, the expenditure must be directly related to the following – with no intervening steps:

- “the SR&ED work;

- the SR&ED staff;

- the equipment used by staff to perform SR&ED.”

The CRA views the question of an expenditure being directly related to the prosecution of SR&ED as a question of fact – and as such, the fact must be verifiable and documented to show it.

Enhanced Capital Recovery’s team of technical consultants are experts in helping you determine if expenditures meet these guidelines.

Example of directly related SR&ED expenditures

Here are some examples of expenditures that may be considered to be directly related to the prosecution of SR&ED sourced from the CRA website:

- “Salary or wages of clerical and administrative staff providing a service to SR&ED employees if the functions performed are non‑technological and aid the ongoing SR&ED claimed in the year;

- Contract costs – other than a SR&ED contract Employer’s share of related benefits;

- Moving expenses related to the relocation of SR&ED employees to another facility;

- Lease costs of equipment used less than 90% of the time in SR&ED;

- Other expenditures, such as: long-distance telephone charges, expenses for travel and lodging, cost of training in Canada, cost of utilities; and others”

Directly related expenditures not eligible for investment tax credits

Also, some expenditures may be directly related to the prosecution of SR&ED, but they are considered prescribed expenditures and do not earn investment tax credits. These expenditures could be included in the pool of deductible SR&ED expenditures but would not be qualified expenditures for the purposes of calculating the ITC amount. These include the following, sourced from the CRA website:

- “Fees for preparing SR&ED claims

- Cost to attend conventions or conferences

- Interest expenses

- Certain expenditures, including salary or wages, that relate to the general administration or management of a business are generally not allowable for SR&ED purposes. These costs are not directly related to the prosecution of SR&ED; they are related to the carrying on of a business.”

Examples of indirect expenditures

Expenditures incurred by the business which are generally not directly related to the prosecution of SR&ED are not eligible. A few examples include:

- “taxation;

- legal services;

- sales, marketing, and advertising;

- shipping and distribution (other than shipping and distribution costs of experimental products for internal or customer testing);

- production (other than materials or equipment used in SR&ED).”

For detailed policy instructions, please see the CRA’s website; also read more about SR&ED Salary and Wages Policy in our blog.

Contact Enhanced Capital Recovery today for a free consultation to determine if your project is eligible for SR&ED or to review a current or past SR&ED claim.